omaha ne sales tax rate 2019

There is no applicable county tax city tax or special tax. The Nebraska state sales and use tax rate is 55 055.

This is the total of state county and city sales tax rates.

. The latest sales tax rates for cities in Nebraska NE state. Nebraska sales tax changes effective July 1 2019. January 2019 sales tax changes.

The Nebraska state sales and use tax rate is 55 055. A state sales tax rate of 625 cents would push the state past Iowa 6 cents and make us higher than every neighboring state except Kansas 65 cents. Make a Payment Only.

Several local sales and use tax rate changes take effect in Nebraska on July 1 2019. The local sales tax rate in Omaha Nebraska is 7 as of October 2022. Alice Homan 8 of Omaha pretends to use a telephone alongside her mother Sen.

The bill requires online retailers to collect sales taxes once they have 100000 worth of sales or at least 200 transactions in Nebraska. Nebraska Tax Rate Chronologies Jurisdiction Effective Date Rate Jurisdiction Effective Date Rate Jurisdiction Effective Date Rate Table 5 Local Sales Tax Rates Continued Rushville. Papillion NE Sales Tax Rate.

Rates include state county and city taxes. More are slated for April 1 2019. The latest sales tax rate for Omaha NE.

Several local sales and use tax rate changes took effect in Nebraska on January 1 2019. Nebraskas sales tax rate is 55 percent. The state capitol Omaha has a.

Here are rates for cities around Omaha. Rich in history and culture the area became well-known for its jazz. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

What is the sales tax rate in Omaha Nebraska. 2020 rates included for use while preparing your income tax deduction. Close online purchasing shopping credit card black.

Sales Tax Rate Finder. In October of 2019. Local sales taxes may.

The Nebraska state sales and use tax rate is 55 055. Sale tax rates vary from city to city. Coleridge Nehawka and Wauneta will each levy a new.

Megan Hunt of District 8 during the first day of the 2019 Legislative Session at the Nebraska. Request a Business Tax Payment Plan. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax.

May 26 2019. Lawmakers are questioning a proposal that would raise Nebraskas state sales tax and steer the extra revenue into tax credits for low-income residents and property owners. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated.

North Omaha Nebraska the birthplace of Malcolm X was a thriving African American neighborhood. State Tax Rates. The sales tax rate in Omaha is 7.

Iowas is 6 percent. AP Republican gubernatorial challenger Tim James on Wednesday called for a. 2020 rates included for use while preparing your income tax deduction.

Sales and Use Tax. This rate includes any state county city and local sales taxes. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska.

Form Title Form Document Nebraska Tax Application with Information Guide 022018 20 Form 55 Sales and Use Tax Rate Cards Form 6 Sales and Use Tax Rate Cards Form 65. The minimum combined 2022 sales tax rate for Omaha Nebraska is.

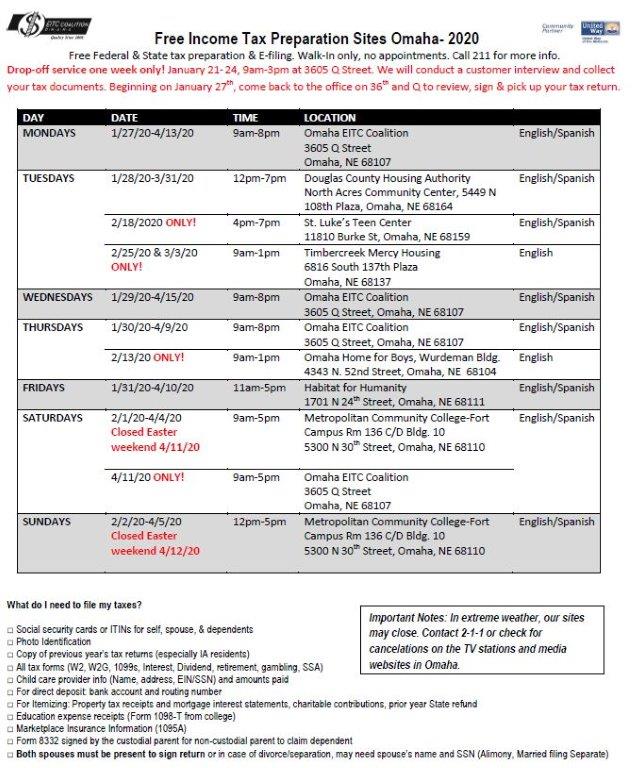

Free Tax Preparation Sites In Omaha Nebraska Department Of Revenue

Omaha Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

State And Local Sales Tax Rates Midyear 2019 Tax Foundation

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Sales Taxes In The United States Wikipedia

Legal Aid Of Nebraska Will Continue To Fight For Property Rights Of Low Income Homeowners Facing Tax Sales Despite Today S Nebraska Supreme Court Ruling Legal Aid Of Nebraska

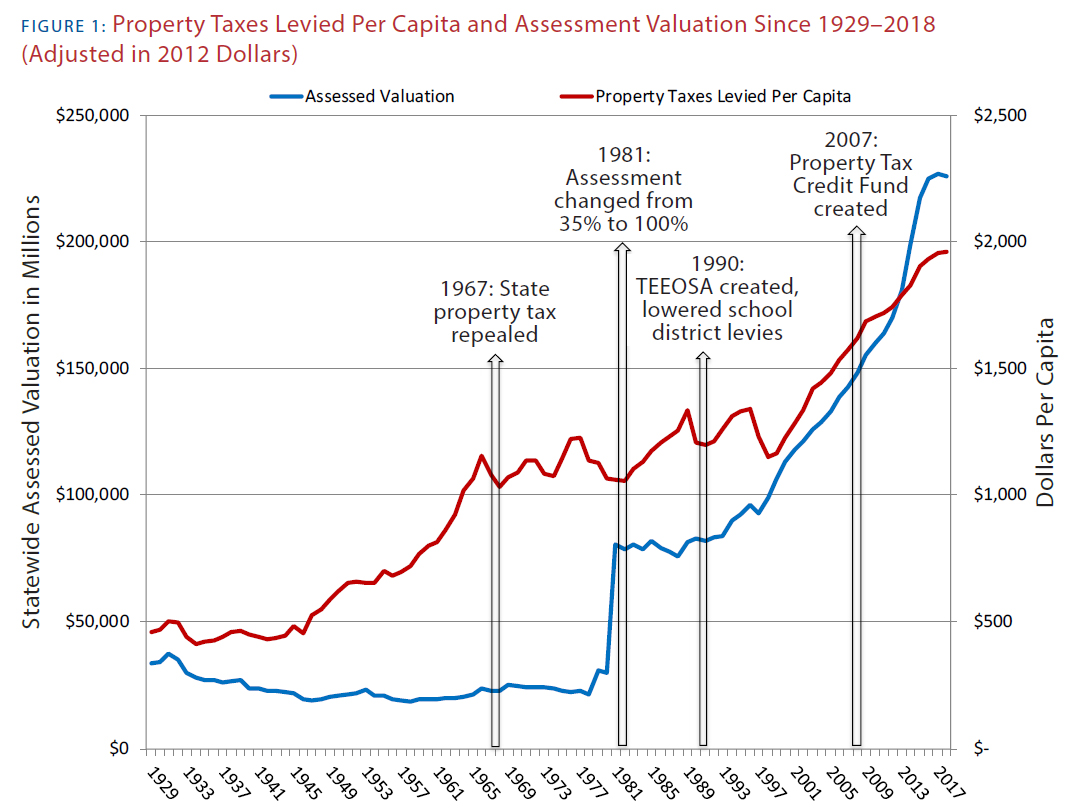

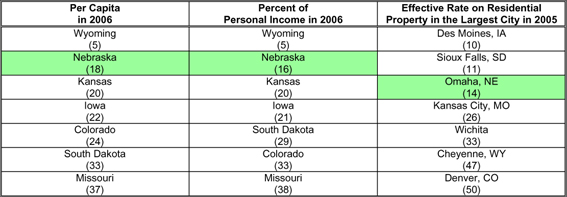

Taxes And Spending In Nebraska

Nebraska Sales Tax Rate Rates Calculator Avalara

Pre Owned Mercedes Benz Sales In Omaha Ne Pre Owned Mercedes Benz

Nebraska Strongest Job Recovery Market Resides In Nebraska Rebounding From The Pandemic The Cornhusker State Flexes Its Muscle Site Selection Magazine

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

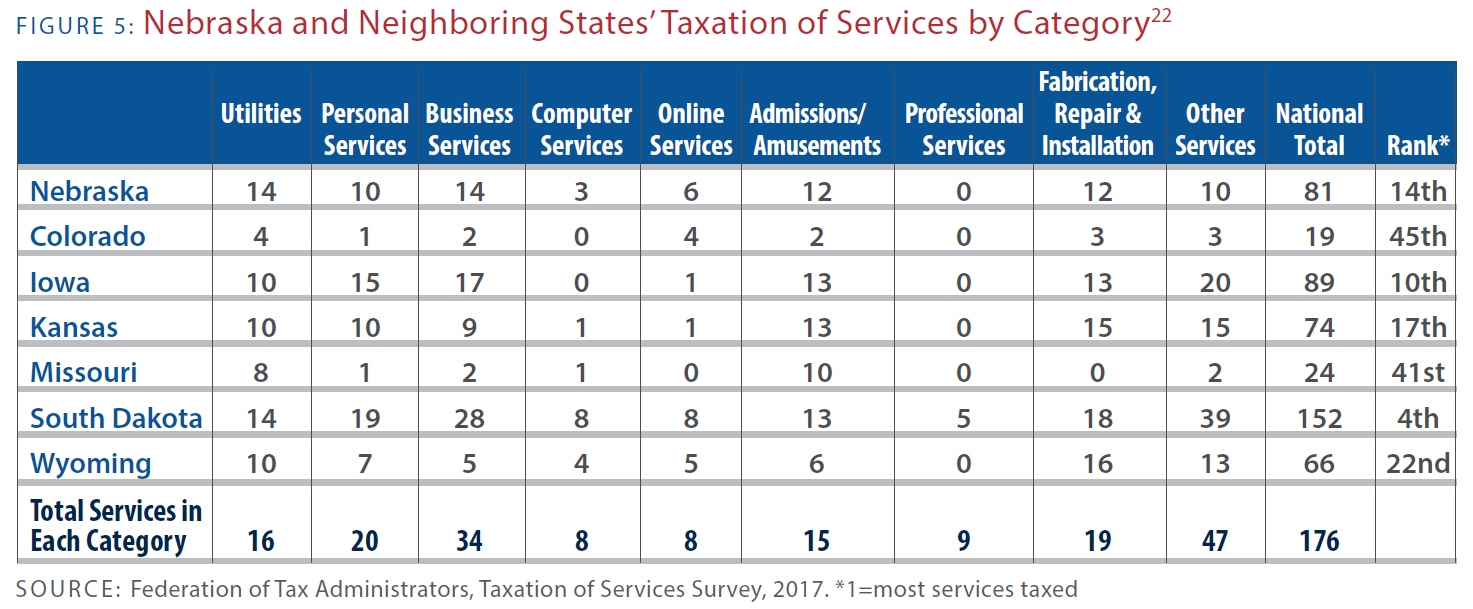

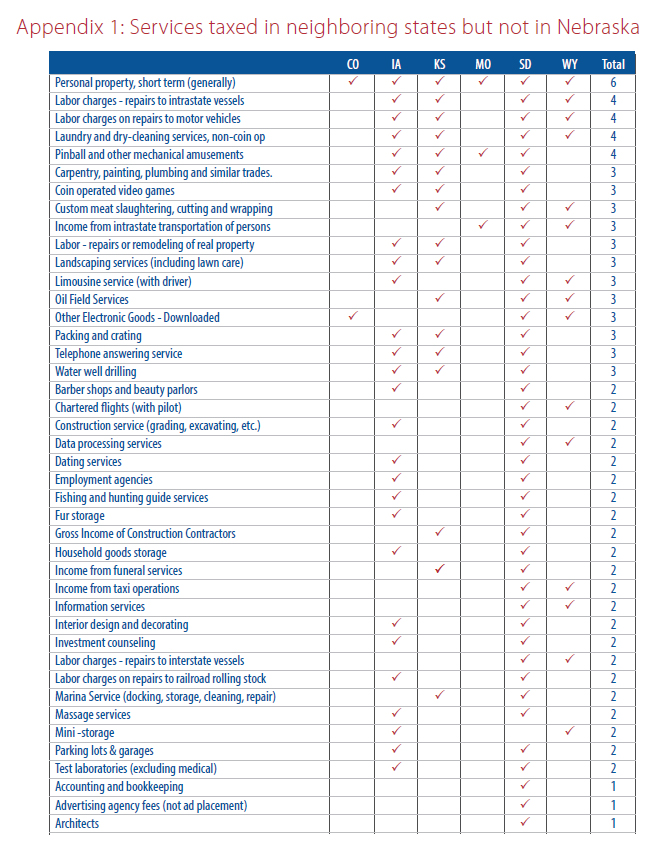

Taxes And Spending In Nebraska

Nebraska Sales Tax Rate Changes January And April 2019

Sales Taxes In The United States Wikipedia

Jeep Dealer Near Omaha Gene Steffy Auto Group Fremont